Liability Wall

Sales Process

Building long-term client relationships is a challenge when clients view their interactions with insurance agents as transactional rather than advisory.

It’s disheartening when clients see you just as a salesperson rather than the trusted advisor you strive to be. Short-term interactions rarely lead to sustained business or referrals.

It's About Mastering Client Connections

efficiency, understanding, and lasting relationships

Three Steps is all it takes

Step 1: Tailor your review to uncover hidden risks.

Step 2: Educate your clients succinctly about their vulnerabilities.

Step 3: Offer tailored solutions that feel less like a sales pitch and more like a lifeline.

A closed Mouth doesn't get fed.

Don’t let your clients be part of this alarming statistic. Our step-by-step sales process empowers you to identify gaps, discuss critical risks, and fortify their future with a comprehensive ‘wall of protection’. Start making a difference today—because when disaster strikes, a phone call to you should be their lifeline, not a missed opportunity.

A proactive approach

Meet Sarah. Last year, she faced the unimaginable—a lawsuit that threatened her family’s future. Thanks to her agent’s proactive approach, they had added an essential coverage just months before. With our strategic 3-step sales process, we ensure you’re not just selling insurance; you’re providing peace of mind, just like Sarah’s agent did. Let’s protect every ‘Sarah’ in your client list—because you’re not just an agent, you’re a guardian.

No Brainer Pricing

Invest in Expertise: Only $250 a Year!

For just $250 annually, you can elevate your sales strategy, deepen client relationships, and streamline your processes. That’s less than a dollar a day for a proven system that grows with you and pays for itself through enhanced client satisfaction and increased sales opportunities. Dive into a transformative sales experience—invest in your success today!

HEre is a break down of how the process works

Assess - Discuss - Build

Assess: Become aware of their Needs

Discuss: The 7 Major risks that all people face

Build: A wall Of Protection

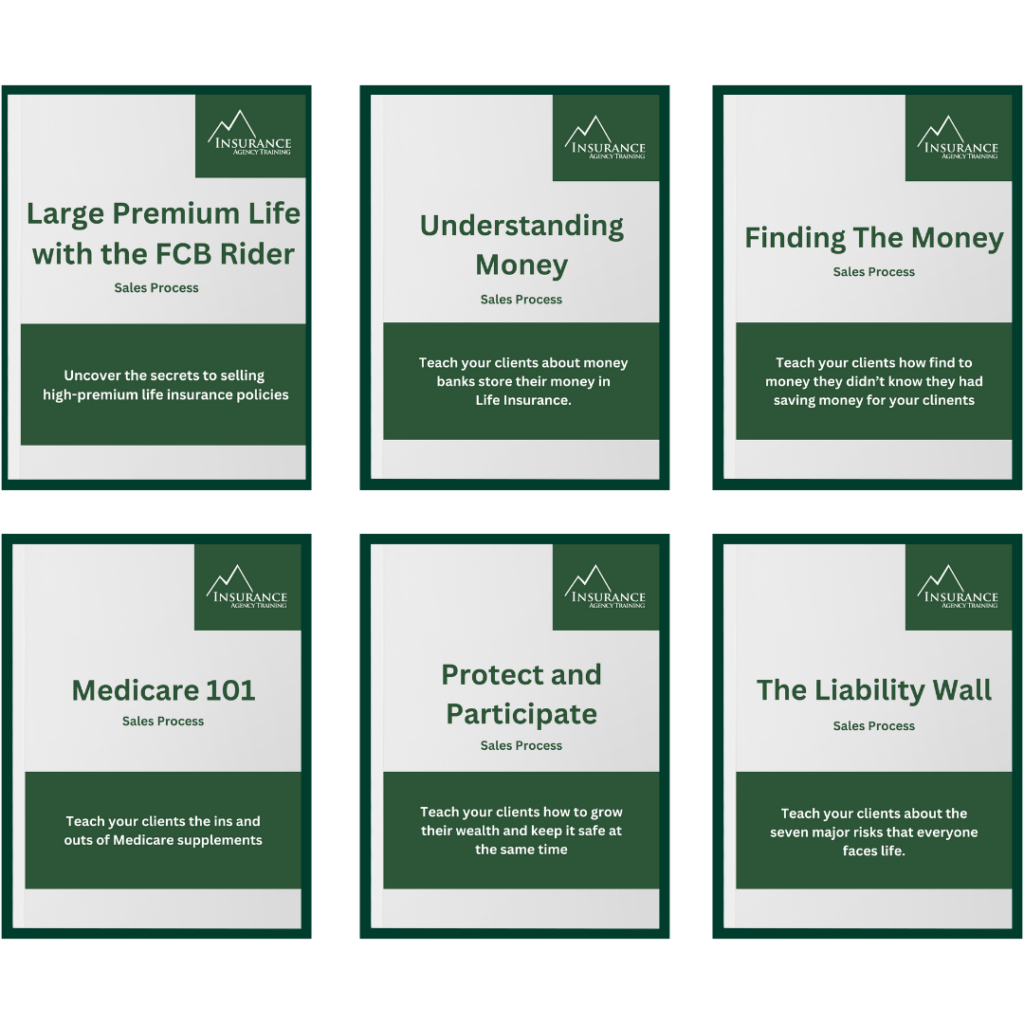

PURCHASE OUR ENTIRE LINE UP OF SALES PROCESSES

6 More sales processes to add to your Skills

StaIrs And Buckets

Achieve perfect sales every time!

A repeatable, simple 4-minute video tool to consistently educate your customers.

Save time and make $100,000+ using Stairs and Buckets

Processes Package

- Large Premium Life with FCB Rider

- Medicare 101

- Understanding Money

- The Liability Wall

- Protect and Participate

- Millionaire Money

Disclaimer

Insurance Agency Training and Stairs and Buckets does not have a Master Services Agreement in place with your Insurance Company. We have worked closely with your compliance department and agents are not prohibited from using our services.

Specific vendors in which your Insurance Company has an approved Master Services Agreement in place and the scope of the vendor services received are considered a company approved vendor within the scope of the agreement determined by your company.

Insurance Companies do not generally dictate what vendors and independent contractors use. It is the agent’s responsibility to ensure that the vendors they engage with do not raise concerns.

Unauthorized Vendors: Specific vendors that your company has identified as being unauthorized for use due to the risks posed to your company by engagement with the vendor. Agents should not use an unauthorized vendor. If an agent does use an unauthorized vendor, it could impact the relationship between the agent and their appointed companies.

Please feel comfortable and use our services appropriately!