Millionaire Money

BUILD WEALTH WITHOUT WORRY

WHy Use Our Process?

We Make Selling Medicare Supplements Easy

TEACH THEM TO THINK LIKE A BANK

TEACH THEM HOW TO PROTECT THEIR ASSETS

SAFE INVESTMENT STRATEGY

Learning and using this process allows you to offer your clients unparalleled insights into safe, tax-efficient, and profitable investment strategies.

GAIN TRUST

By providing a service that mirrors the strategies of top financial institutions, you position yourself as a knowledgeable and trustworthy advisor, which is key to building long-term client relationships and increasing referrals.

SAFE INVESTMENT STRATEGY

Adopting this approach will set you apart from competitors, helping you attract and retain high-net-worth clients who are seeking savvy financial solutions that go beyond traditional investment avenues.

No Brainer Pricing

Sale Price $250 per year

Consider the ‘Millionaire Money’ sales process an investment in your future success, available to you at just $250 per year.

This process offers you a structured approach to engaging high-net-worth clients by mimicking the investment strategies of major banks.

The potential returns in terms of increased client acquisition, higher transaction values, and enhanced client loyalty far exceed the annual cost.

By investing in this learning, you’re not just spending money; you’re investing in a tool that will multiply your income and professional growth.

HEre is a break down of how the process works

Educate - Demonstrate - Covert

Educate:

Begin by discussing common financial sayings and principles to establish a shared understanding and rapport. Explain how major banks manage their funds, using simple questions to gauge the client’s current financial knowledge and investment strategy.

Demonstrate:

Convert:

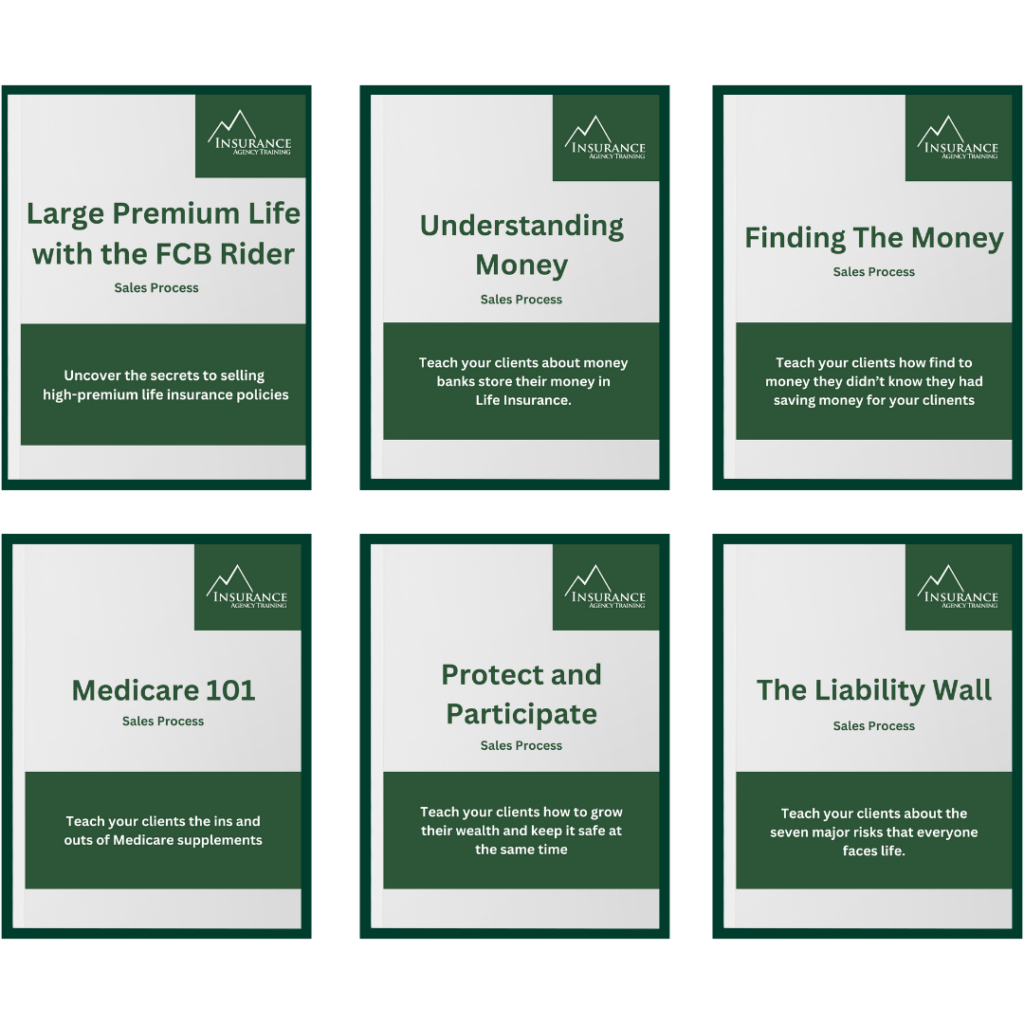

PURCHASE OUR ENTIRE LINE UP OF SALES PROCESSES

6 More sales processes to add to your Skills

StaIrs And Buckets

Achieve perfect sales every time!

A repeatable, simple 4-minute video tool to consistently educate your customers.

Save time and make $100,000+ using Stairs and Buckets

Processes Package

- Large Premium Life with FCB Rider

- Medicare 101

- Understanding Money

- The Liability Wall

- Protect and Participate

- Millionaire Money

Disclaimer

Insurance Agency Training and Stairs and Buckets does not have a Master Services Agreement in place with your Insurance Company. We have worked closely with your compliance department and agents are not prohibited from using our services.

Specific vendors in which your Insurance Company has an approved Master Services Agreement in place and the scope of the vendor services received are considered a company approved vendor within the scope of the agreement determined by your company.

Insurance Companies do not generally dictate what vendors and independent contractors use. It is the agent’s responsibility to ensure that the vendors they engage with do not raise concerns.

Unauthorized Vendors: Specific vendors that your company has identified as being unauthorized for use due to the risks posed to your company by engagement with the vendor. Agents should not use an unauthorized vendor. If an agent does use an unauthorized vendor, it could impact the relationship between the agent and their appointed companies.

Please feel comfortable and use our services appropriately!